HOMESTEAD EXEMPTION = An Awesome Property Tax Break for Florida Homeowners

Share this page:

by Editor - VeroBeach.com |

Real Estate

Florida residents can receive up to $50,000 property tax exemption for their home by filing for Homestead Exemption. The filing period is January 1 to March 1.

To qualify, the home must be your primary residence and you must have owned the property on January 1st. Once granted, Homestead Exemption automatically renews.

Tax Breaks with Homestead Exemption . . . for the first $50,000 in assessed value of your home, $25,000 is exempted from property taxes. This exemption applies to ALL property taxes.

For assessed value of your home between $50,000 and $75,000, an additional $25,000 is eligible for exemption, however this exemption does NOT apply to school district taxes.

The other HUGE upside of filing Homestead Exemption for your primary Florida residence is a cap on the assessment of your home,

Through the ‘Save Our Homes’ initiative, the assessed value of homes receiving Homestead Exemption can NOT be increased more than 3% annually, no matter how much the value of your home increases. This goes into effect a year after you receive Homestead Exemption.

The Indian River County Property Appraisers office is headed by Wesley Davis, a lifelong county resident and expert in the real estate space. Mr. Davis has streamlined the Homestead Exemption application process and developed an easy “Homestead Super Service Plan” so people can easily apply online, in person or by phone.

Here’s an overview of Homestead Exemption with phone numbers & direct links to apply.

TOPICS

- Real Estate (5)

- Education and Tutoring (1)

- Health + Beauty (1)

- Home Services (1)

- Marketing (2)

- Medical (7)

- Not For Profit - Volunteer (1)

- Shops (2)

- Things To Do (1)

RECENT POSTS

HOMESTEAD EXEMPTION = An Awesome Property Tax Break for Florida Homeowners

Florida residents can receive up to $50,000 property tax exemption on their Florida home by filing for Homestead Exemption. The filing period is January 1 to March 1.

To qualify, the home must be your primary residence and you must have owned the property on January 1st. Once granted, Homestead Exemption automatically renews.

Summerplace, an Old Florida seaside community in Vero Beach, Florida Established 1961

History of Summerplace, an eclectic seaside community developed by Anthony Drexel Duke. All properties have deeded access to the private Summerplace beach on the north barrier island in Vero Beach, Florida. See homes and homesites available for purchase.

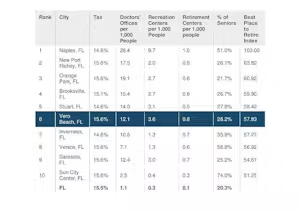

Vero Beach Popping Up On "Best Places To Retire In Florida" Lists

See how Vero Beach compares to other Florida cities when it comes to retirement.

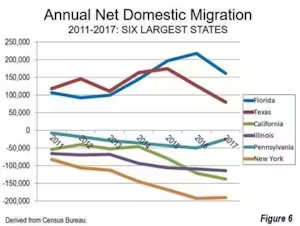

Florida Most Popular Destination in the Nation for Relocating Homebuyers

No state income tax, low cost of living, warm weather, tons of beaches and relaxed lifestyle continue to be the draw.

Coastal Living Magazine Names Vero Beach, FL as One Of "Top 10 Happiest Seaside Towns in America”

Described as the "Carmel of the Atlantic", Vero Beach happily took the 4th spot in this years assessment of more than 300 seaside towns.